Maybe you just want to avoid public transport for the next few years until the threat of infection passes.

Or maybe you’re wondering whether maybe, just maybe, it’s a good time to buy a car now. After all, the roads are less congested and you still need to get around somehow.

We’ll do a deep dive into how much it costs to own a car in Singapore over the full 10-year COE period.

We’ll also touch on how buying brand new compares with buying a resale car and how much you could potentially save with a weekend car license.

Table of Contents

- The assumptions for our calculations

- The purchase cost of a car

- Maintenance and ongoing fees

- Hidden costs of car ownership

- The bottom line (how much you’ll pay over 10 years)

- Ways to save on the costs

- How it compares to owning a secondhand car in Singapore

- How much you could save with a weekend car license a.k.a. off-peak car

Read also: When’s the Best Time to Buy a Car? [COE Price History]

The Cost of Owning a Car in Singapore in 2021

There are a lot of numbers to cover, so we’ll use a story to simplify the calculations for you. For the purposes of our hypothetical calculations, these are the assumptions we made:

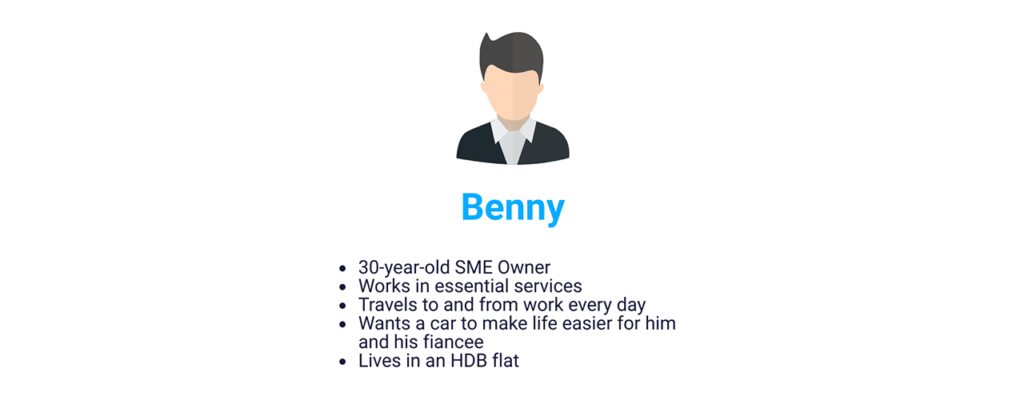

The Main Character of Our Story

The main character of our story is Benny, a 30-year-old who founded his own SME in Singapore. His company provides essential services, so he still travels to and from work every day. He decides to get a car to make life easier for himself and his soon-to-be wife.

Like 80% of all Singapore residents, Benny lives in an HDB flat. He plans to park his car in the HDB sheltered car park.

All this information will be important later on, so keep Benny in mind!

Read also: Cost of Car Ownership [Singapore vs The Rest of the World]

Purchase Costs

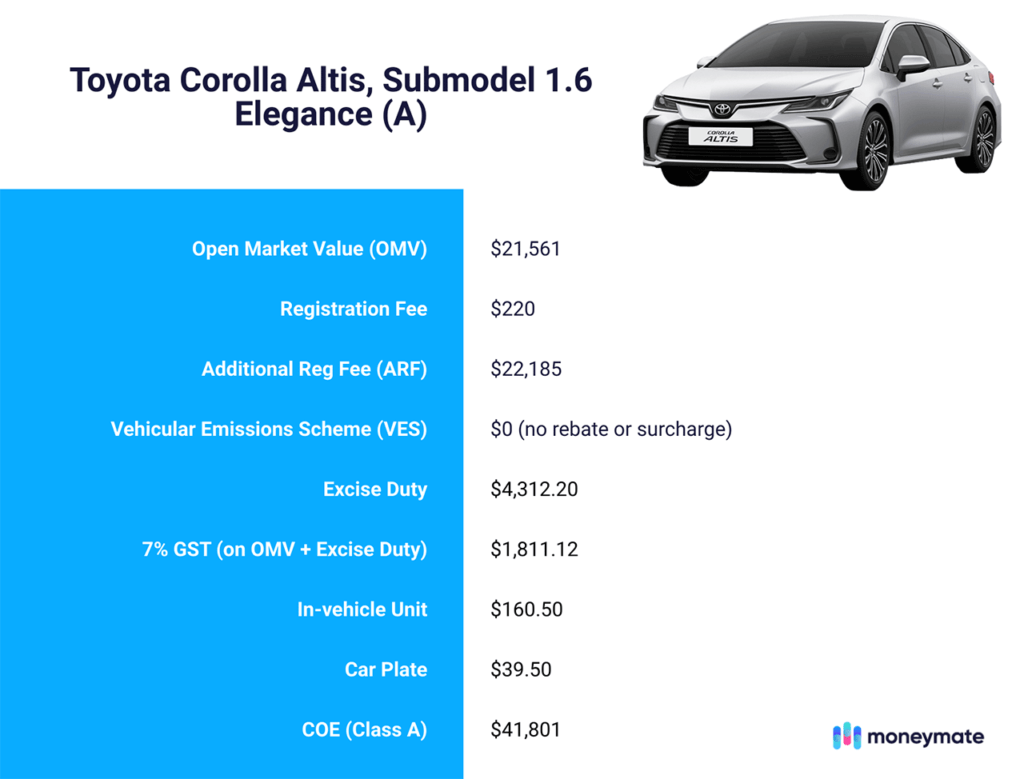

Like a lot of people in 2020, Benny decides on the Toyota Corolla Altis for his new wheels. Here’s the breakdown of the various costs (accurate as of 22 May 2021):

The cost of the car, registration fee, various taxes, in-vehicle unit, and car plate total $92,090.32.

The dealer’s package for the Toyota Corolla Altis is $110,888, which is a 20.4% markup. (A 10-50% markup is common for dealers to cover their costs and commissions, depending on the car model.)

Let’s go through each of the costs:

Open Market Value (OMV)

This is the price of the car on the open market before fees, surcharges, and the various taxes. It includes the car’s purchase price, freight charges, insurance, and incidental costs.

Registration Fee

This is the standard fee for all new cars.

Additional Registration Fee (ARF)

This is an extra tax the government levies on new cars. It’s calculated based on the OMV of the vehicle:

| OMV of Vehicle | ARF Rate (% of OMV) |

|---|---|

| First $20,000 | 100% |

| Next $30,000 | 140% |

| Above $50,000 | 180% |

The cheaper the car, the lower the ARF.

If Benny chooses to deregister his car before the 10-year COE mark, he can get rebates through the Preferential Additional Registration Fee (PARF) system.

Vehicular Emissions Scheme (VES)

You probably guessed it: this is a tax the Singapore government imposes to encourage buyers to choose more eco-friendly vehicles. You get a rebate for more eco-friendly vehicles but pay a surcharge for not-so-friendly ones.

The Toyota Corolla Altis is rated Band B under the VES, so it doesn’t qualify for a rebate. Thankfully, Benny doesn’t have to pay a surcharge either.

Excise Duty

This is a tax the government imposes on what they consider “luxury goods.” Alcohol, tobacco, cars, and petrol or biodiesel products all incur this.

The Excise Duty is 20% of the OMV of the car.

In-vehicle Unit

This is the card reader that dealers install in new cars. A new unit actually costs $155.80, but Borneo Motors charges Benny $160.50 after GST.

Car Plate Fee and License Plate Number

Benny has to pay for the car plate, but LTA will assign him a license plate number for free. Like the fiscally responsible person he is, he chooses to go without a custom license plate number (which can go for a grand to several hundred grand).

Certificate of Entitlement (COE)

This is the biggest cost and why it’s so expensive to own a car in Singapore — you need to purchase the right to own a car before you can actually buy one.

COE prices change all the time because the final prices are determined through bidding.

The Toyota Corolla Altis falls under the Class A category. Since Benny bought a new car, we’ll use the Quota Premium of $41,801 (accurate as of May 2021).

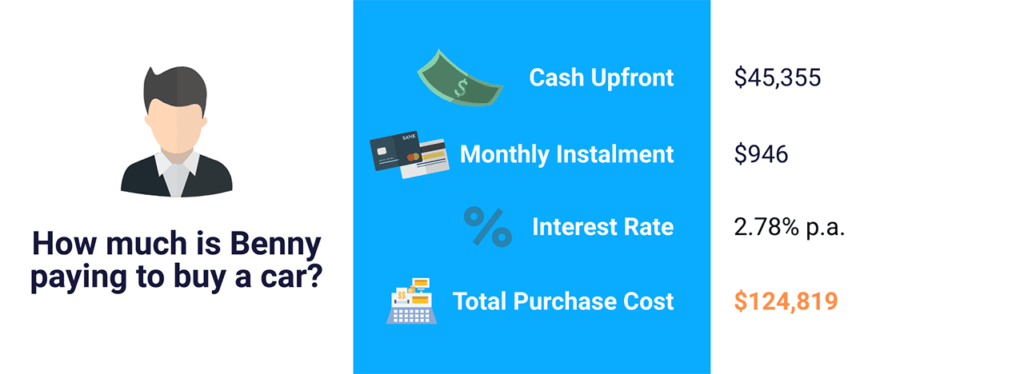

Down Payment, Car Loan Instalments, and Interest

Since the Toyota Corolla Altis has an OMV of over $20,000, Benny can take out a max loan of 60%. That leaves him 40% he needs to pay in cash as a down payment ($45,355).

Afterwards for the next 7 years, he’ll need to cover the monthly loan instalments of $946. This includes a flat rate interest of 2.78% per annum.

Total Purchase Cost

All in, Benny will end up paying $124,819 to buy his Toyota Corolla Altis.

Read also: Best Car Rental Services in Singapore [2021 Comparison]

Maintenance and Ongoing Costs

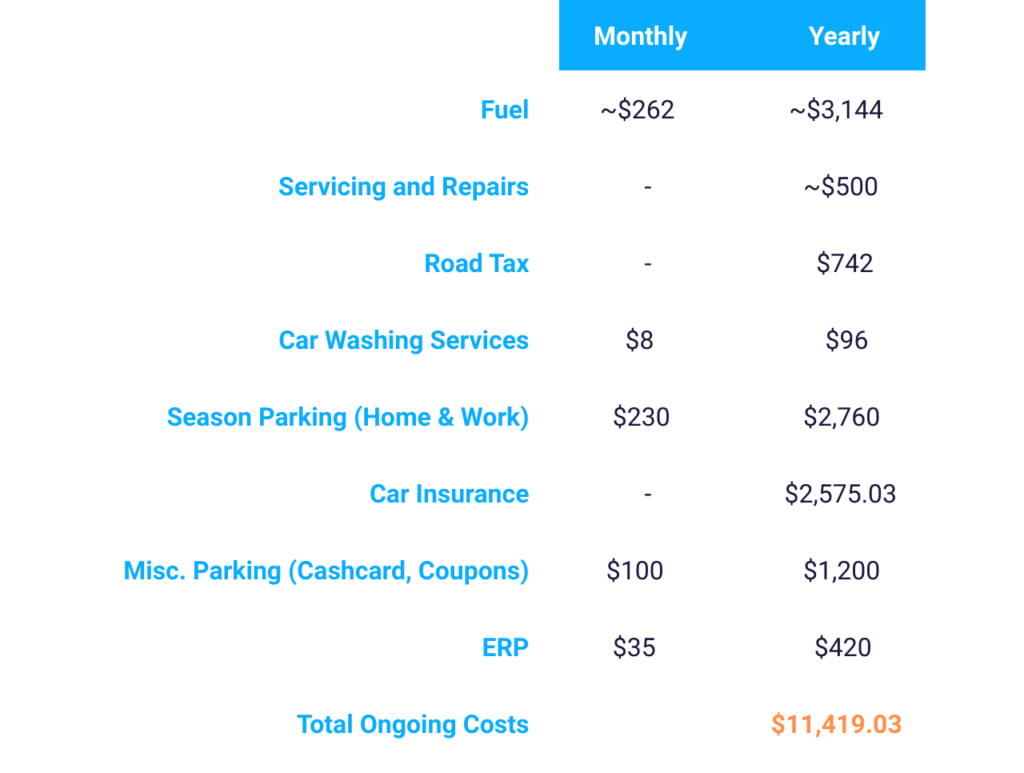

The purchase costs are just the beginning. Here’s a quick snapshot of how much it’ll cost Benny to keep his Toyota Corolla Altis:

Let’s break this down line by line.

Fuel

Let’s assume Benny clocks the average annual mileage of 17,500km. Toyota lists the fuel consumption for the Corolla Altis at 15.6 km/L, but with all the start-stop driving in urban Singapore, it’ll probably only get around 13km/L.

That means he’ll need 1,346 L of petrol per year.

At an average price of $2.328/L, that works out to be $261.12 per month or $3,133.49 a year for petrol.

Servicing and Repairs

Since Benny bought a new car, he only has to take his car for regular servicing. If it’s just a routine check, it’ll cost about $250. More major servicing (like tyre replacements) will cost $400.

We’ll say he spends about $500 a year on servicing and repairs. He may spend more as his car gets older, depending on how well he maintains the vehicle.

Road Tax

This is based on the engine capacity of your vehicle. For the Toyota Corolla Altis, it’s $742 per year.

Car Washing Services

This is optional since Benny can always choose to wash his car on his own. But assuming he uses a car wash service every month, it’s $8 per wash.

Season Parking for Home and Office

The HDB sheltered car park costs $110 a month for season parking. He also has URA sheltered parking for his office, which costs $120/mo for season parking.

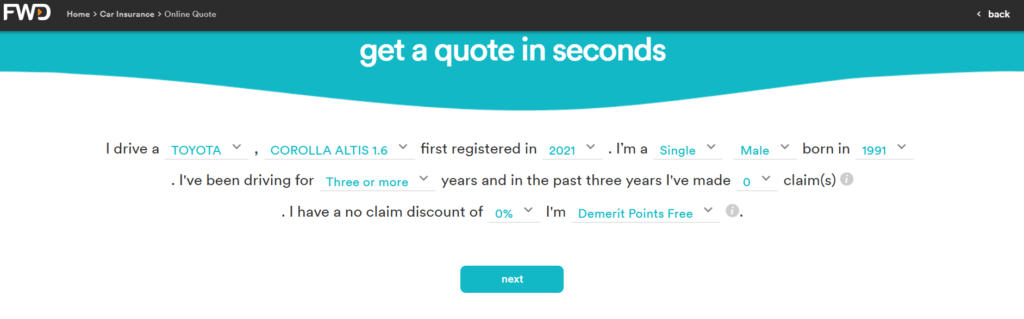

Car Insurance

The annual premium you’ll pay depends on your risk profile and driving experience. For our story, Benny is a 30-year old male who’s been driving for three years. He hasn’t made any previous claims and has no demerit points.

FWD quoted him $2575.03 per year for the mid-tier plan.

Hidden Costs

These are the little amounts that add up over time, including…

Misc. Parking and ERP

These are your cashcard top-ups and parking coupon booklets. Parking at shopping malls is no joke: you can sometimes pay $10-30 for parking after a leisurely day out.

You can avoid ERP charges if you plan your routes carefully. But to be safe, we’ll say Benny spends $35 a month on ERP.

Traffic Fines

We’ll assume Benny is fortunate enough not to get any traffic fines. But if you do get fined, here’s a quick list of what to expect:

- Speeding ticket: up to $300

- Running a red light: up to $500

- Using a phone while driving: up to $1,000

- Not wearing a seatbelt: up to $200

Depreciation

The car starts depreciating the moment you drive it off the dealer’s lot, so…yup. Benny will lose around 10k in value every year.

If you want to recoup some of your costs, you do get a PARF rebate for de-registering a vehicle that’s less than 10 years old. The newer your car is, the greater the rebate.

The basic formula is:

PARF rebate = ARF x % based on the age of your car

| Age of Vehicle | PARF Rebate |

|---|---|

| Less than 5 years | 75% of ARF |

| Above 5 but less than 6 years | 70% of ARF |

| Above 6 but less than 7 | 65% of ARF |

| Above 7 but less than 8 | 60% of ARF |

| Above 8 but less than 9 | 55% of ARF |

| Above 9 but less than 10 | 50% of ARF |

| Above 10 years old | Nothing |

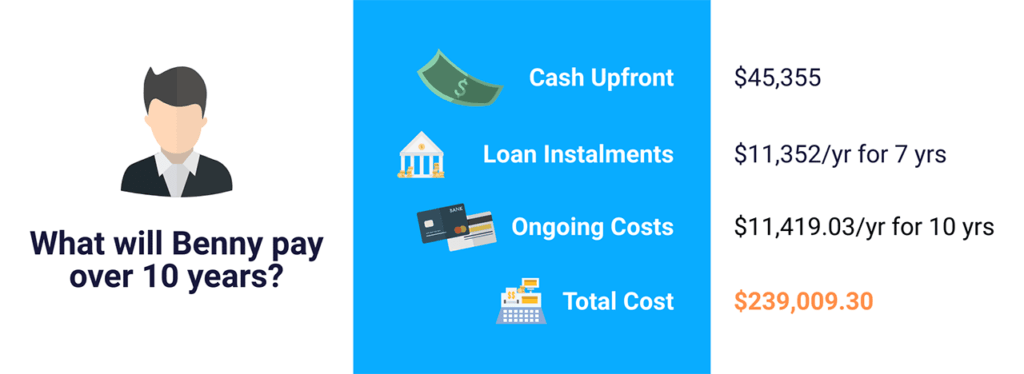

The Total Cost Over 10 Years

So after aallll those numbers…how much is our dear Benny really paying?

And the final score is in:

$239,009.30 over a 10-year period. That’s pretty much enough to buy a small flat — or even make the downpayment for a condo.

Ooookay…Are There Ways to Save?

Owning a car is still going to be costly, but it’s possible to save a bit here and there. Here are a few methods:

1. You can save on petrol by turning off your car if you’re idling.

Drivers tend to think that idling uses less fuel than stopping and restarting, but studies have found that you can reduce fuel wastage and emissions by shutting down the engine — even for stops as brief as 10 seconds. (Do this in a safe place though…not in the middle of traffic!)

2. Drive safely.

We’re not just throwing out a platitude here: there’s actually a pragmatic reason to not drive aggressively. Things like staying within the speed limits, not taking sharp turns, and not slamming on the brakes increase fuel efficiency.

Driving safely could potentially save you hundreds of dollars in petrol every year.

3. Use the best petrol credit cards

Certain cards will offer you discounts at petrol kiosks. You’ll also get other benefits, like mileage points (which you can now spend at local stores if you’re not up to flying in the middle of a pandemic) and rebates on general spending.

4. Go electric

There are a number of perks if you buy an electric vehicle, like:

- The sizable VES rebate. A new Renault Zoe goes for $99,999 — including a $25,000 VES rebate and $17,719 early adopter rebate.

- Lower road taxes. ‘Nuff said.

- Lower fuel costs (in the form of electricity). Your energy costs will likely be in the hundreds of dollars compared to the thousands you’d have spent on petrol.

- Lower maintenance costs since an electric car engine runs more cleanly.

The one downside is that charging stations aren’t as plentiful on the island at this point.

This is changing though: the Singapore government is planning to ramp this up and completely phase out petrol-based cars by 2040. By 2030, there will be 60,000 charging stations around the island.

How About the Cost of Owning a Used Car?

A five-year-old Toyota Corolla Altis (registered 2016) with a low 37,000km in mileage could go for $58,888 according to SGCarMart.

That means a few possible benefits to buying a resale car:

- It could be cheaper if you can afford the 59k upfront. It’s only 14k more than the downpayment Benny had to pay on his new car, but he’d be saving almost that same amount in interest payments.

- Depending on the condition of the car and when during the COE cycle you buy it, resale cars depreciate at a slower rate.

- COE prices tend to rise and fall in cycles. If you get your secondhand cars with COE prices at the lows of the cycle, you may be saving upwards of $10,000. Of course, this could also work in reverse — if you don’t do your research well, you could be buying at the peak of the cycle.

Before you buy a resale car, make sure to assess the mileage and condition of the car beforehand. You don’t want to buy a resale car only to end up paying a lot more in maintenance!

How Much Cheaper is an Off-Peak Car?

You’ve probably seen cars with red license plates around. Commonly known as weekend cars, these are cars that you can only use during certain timings.

In exchange, you’ll get significant rebates:

- Up to a $17,000 rebate to offset COE and ARF

- Up to $500 in savings on road tax annually (subject to $70 minimum road tax)

- Lower insurance premiums

All the other costs are still at play. You still need to pay for parking, COE, petrol, ERP, inspection fees, and so on.

But over the years, you could knock off tens of thousands of dollars from the total cost.

Practically speaking, what does an off-peak car mean for me?

Let’s say you opted for the Revised Off-Peak Car (ROPC) scheme. This puts the least restrictions on your use of the car on weekends and public holidays. You can drive the car anytime during the weekends and after 7pm on weekdays.

And with an off-peak car, it’s still possible to use the car during restricted hours. You just need to purchase an e-Day license for $20 (you’ll need to plan this in advance though).

If you have convenient public transport routes and don’t have children or elderly relatives to ferry around, this is pretty doable.

Read also: Car Sharing Operators in Singapore: Which is Best?