As of June 2020, 9.7% of Singapore’s workforce were Own Account Workers — otherwise known as freelancers.

Like every other job, being a freelancer has its pros and cons. Freelancers have greater flexibility than their salaried counterparts and can even earn well if they have a stable client base. But other factors come into play too.

As a freelancer in Singapore, you’ll have to keep a closer eye on your finances, savings, and retirement planning. This includes CPF contributions since you are on your own.

Read also: A Freelancer’s Guide to Income Tax in Singapore

So where do you start with CPF as a freelancer? This guide will help you with what you need to know about the various CPF schemes and contributions as a freelancer in Singapore.

Table of Contents:

Do Freelancers Need to Pay CPF?

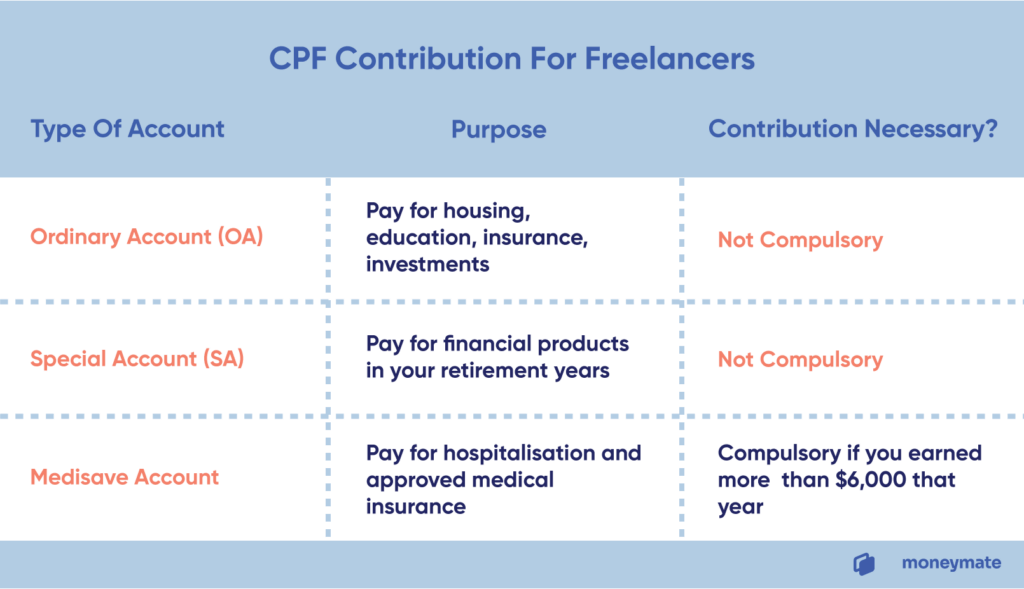

Yep, but mostly to your MediSave Account.

Note that unlike your salaried friends, you won’t get an extra top-up from an employer. That means you’ll also need to account for that 17% to make sure your earnings are comparable to the market rate.

As long as you earn more than $6,000 a year based on your Net Trade Income, you’ll need to contribute to your MediSave Account.

As a freelancer, your Net Trade Income would usually be whatever you earn from your freelance jobs — unless you have extras like a private accountant, business loans, advertising costs, or office rental.

Other than that, contributing to your Ordinary and Special Accounts is optional. But if you’re not yet actively saving and investing for your future, you might want to consider this option. (More on that later.)

How Much Do I Need To Contribute To MediSave?

Your MediSave contribution is pegged to your age and how much you’ve earned for that year.

Here is an overview of the latest MediSave contribution rates:

| Age | Income (NTI) Above $6000 – $12,000 | Above $12,000 – $18,000 | Above $18,000 |

|---|---|---|---|

| Below 35 | 4% | 4 – 8% | 8% (Max: $5,760) |

| 35 to below 45 | 4.5% | 4.5 – 9% | 9% (Max: $6,480) |

| 45 to below 50 | 5% | 5 – 10% | 10% (Max: $7,200) |

| 50 and above | 5.25% | 5.25 – 10.5% | 10.5% (Max, $7,560) |

Alternatively, you can also use this MediSave Calculator to calculate the contribution amount you have to make according to your age and income.

Deadline for MediSave Contributions

After you file your income taxes, IRAS will send you a Notice of Assessment (NOA).

After that, you’ll receive a Notice of Computation (NOC) stating the amount of MediSave contribution you have to make. You’ll need to then make your MediSave contributions payment within 30 days of receiving the NOC.

Freelancers in the Government and Public Sector

For freelancers working in the public sector — like sports coaches in schools — the government is currently piloting the Contribute-As-You-Earn scheme. This means a portion of your earnings will automatically go into your MediSave before you get the rest of your wages.

The scheme aims to make sure self-employed people have smaller but regular contributions rather than forking out a lump sum every year.

How to Contribute to MediSave

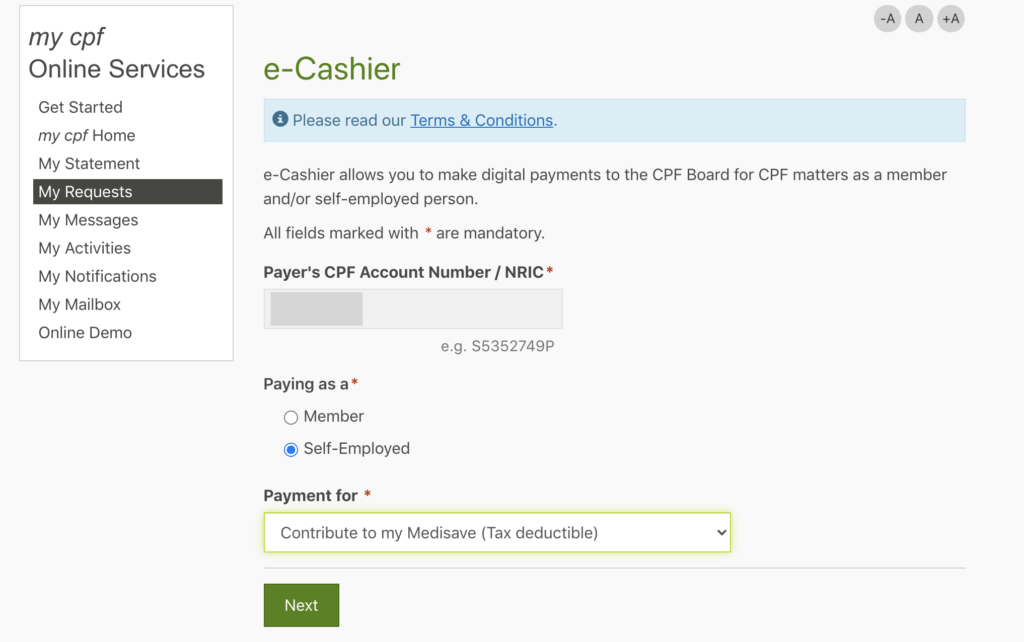

Use your SingPass to log in to the CPF portal.

Click on My Requests > Self-Employed Matters > Make contributions to 3 CPF Accounts or Medisave Account.

Next, check that you’re paying as Self-Employed and select Contribute to my Medisave in the Payment for field.

You’ll then be able to make an eNETS debit payment. Alternatively, you can contribute via GIRO online or NETS/CashCard at SingPost branches.

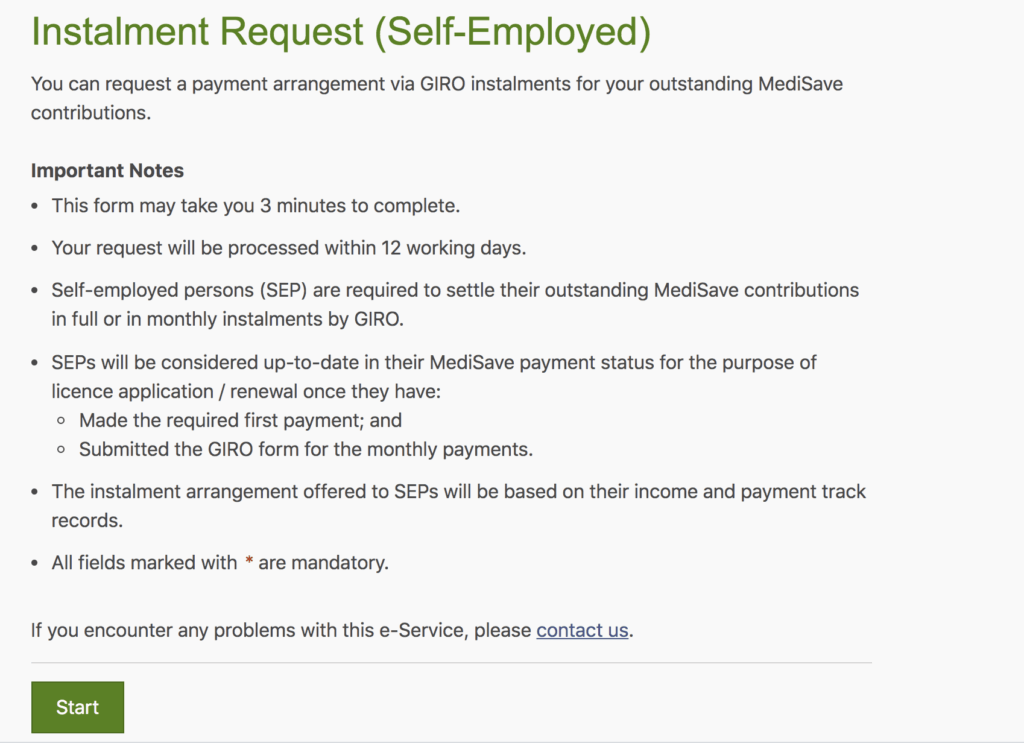

If you can’t pay in full, you can opt to contribute to your MediSave in monthly instalments. Use this Self-Employed Medisave Instalment Calculator to calculate your monthly instalment.

To make payment in instalments, log in to my cpf Online Services and click on My Requests > Self-Employed Matters > Contribute to my Medisave in instalments.

Should I Make Extra Top-Ups to CPF?

We highly recommend it, especially if you don’t have extra money tucked away in investment assets. Unlike most salaried Singaporeans, self-employed people tend not to have the safety net that a compulsory CPF contribution can offer.

Read also: 5 Investment Tips for Beginners in Singapore

Let’s look at the reasons in more detail though:

Pros of Making Extra CPF Top-Ups

Other than the obvious fact of having more funds for retirement, here’s a summary of why it’s beneficial to top up your CPF:

A. You can use your CPF contributions to reduce your income taxes.

There are two schemes you can tap on for this:

- The CPF Relief for Self-Employed Scheme. This assumes you’ve been making contributions to CPF on your own and allows you to reclaim that 37% — up to a cap of $37,740 as of 2021.

- SRS Tax Relief. If you’ve been contributing to your Special Account above and beyond the compulsory CPF contributions, you can get an additional tax relief under this scheme.

Look at it this way: whether you make the extra contributions or pay income taxes, your money’s still going to the government. The difference is that if you voluntarily make those top-ups, you can still use it later on.

B. CPF savings grow faster with a high guaranteed interest.

With a typical savings account at a bank, you may only get 0.05% interest per year. CPF OA, on the other hand, guarantees you a minimum of 2.5% interest per year. Your Special and MediSave accounts give you a guaranteed 4% per year.

Read also: Current vs Savings Accounts in Singapore – What’s the Difference?

How much of a difference is that? If you have $10,000 in cash in your savings account, that means you get a measly $5 in interest per year. That $5 becomes $250 if you put it in your CPF OA.

To sweeten the deal, you’ll get an additional 1% interest on the first $60,000 of your CPF monies (with up to $20,000 from the Ordinary Account). This means you’ll earn up to 3.5% to 5% interest from your CPF monies.

If you’re freelancing for several years, that all adds up.

C. You’ll have money set aside for major expenses.

Sure, you can’t withdraw your CPF to pay for your McDonald’s meal…at least right now. But you can do so to pay for your new flat, get wisdom tooth surgery, or buy a new hospitalisation insurance rider.

Cons of Making Extra CPF Top-Ups

There are still a few matters to take into consideration before topping up your CPF accounts, though. Here are the drawbacks of topping up your CPF:

A. Your money is locked in until age 55.

Once you transfer your money into your CPF, you cannot reverse the decision. So make sure you’re putting in money you don’t foresee yourself urgently needing for the next 6 months, at least.

B. Other financial products can give you similar or better returns.

CPF’s guaranteed interest rates are better than what the banks offer, but you may get even better returns if you put your money into other investments.

StashAway’s robo-advisor projects annual returns of at least 6%, for example. Dollar Cost Averaging into a US ETF may get you 9 – 13% returns annually.

A word of caution though. A higher rate of return also involves higher risks. There’s a greater chance that you’ll lose money in riskier investments, unlike your risk-free CPF account. You should only invest in alternative financial products after doing your own due diligence.

Read also: 5 Investment Tips for Beginners in Singapore