Pros

- No annual fees

- 1% cashback on top of your existing credit card perks

- No top-ups needed

- Competitive FX rates with no transaction fees

Cons

- No ATM withdrawals

- S$500 minimum spending for cashback eligibility

- No multicurrency wallet

- S$100 quarterly cashback cap

Looking to declutter your wallet? Here’s a potential solution.

As a card that can link up to 5 other Mastercards in a single wallet, the Instarem Amaze has been on the rise recently.

But the biggest draw by far is the stackable cashback benefits — meaning you can pair this card with other high cashback cards for an extra 1%. The lower foreign currency conversion rates are sweet, too.

We’ll look into the Instarem Amaze card and weigh these aspects in today’s review:

- How does it work?

- Foreign exchange rates, fees, and limits

- Cashback, discounts, and other benefits

- Best cards to pair with the Instarem Amaze Card

- Instarem Amaze vs other MCA-linked cards

- Who should use this card

How Does The Instarem Amaze Card Work?

Officially launched in December 2019, the Instarem Amaze is a debit card linked to your Instarem account. You can link the Amaze card with up to 5 of your existing debit or credit Mastercards.

Unlike Wise, Revolut, or YouTrip, there’s no top-up needed with the Amaze card. Once you’ve linked your other cards, you can spend directly with it.

Other than the stackable 1% cashback we already mentioned, here’s what the Amaze card offers:

- Close to mid-market foreign exchange rates as sourced from Reuters

- Zero foreign transaction fees

- Integration with Google Pay

- A physical card (you’ll have to request this)

Note: You can’t link the GrabPay Mastercard to Amaze, nor can you withdraw cash with it.

Foreign Currency Exchange Rates and Fees

| Foreign Currency Exchange Rates | Instarem doesn’t publish exact numbers, but they claim to offer “close to published rates” on Google and other financial sites |

| Application Fee | None |

| Annual Fee | None |

| Processing Fee | None |

| Countries You Can Transact In | Anywhere that accepts Mastercard |

| Currencies Supported | All available currencies on Mastercard |

| Foreign Currency Transaction Fees | None |

| Spending Limits | S$50,000 per transaction, or your linked cards’ limits |

Convenient Cashback Card with No Fees

Since Amaze isn’t a credit card, there are no application, annual, and processing fees. This is a no-frills, hassle-free card for all users.

No Spending Limits

At S$50,000 per receipt, you might say that Instarem Amaze doesn’t put a cap on your spending. In fact, your spending limits actually come from your linked card’s respective credit limits.

Transact with Foreign Merchants Easily and Cheaply

With the physical Instarem Amaze card, you can make payments overseas at any merchant that accepts Mastercard. You also won’t have to pay marked up exchange rates or the 3.25% in foreign transaction fees that other credit cards charge.

Cashback, Discounts, and Other Benefits

| Cashback | 1% on top of your credit card perks |

| Cashback Criteria | Minimum quarterly spending of S$500 to be eligible Only applicable for transactions above S$5 Cashback capped at S$100 per quarter Merchants excluded from the cashback system can be found here. Some examples include: – Government & Financial Institutions – Insurance, Real Estate, Hospitals & Schools – Utilities, Cigars, Non-durable goods |

| Other Benefits | Mastercard benefits Doubles as a public transport card Monthly discounts at specific merchants such as Agoda, Grand Shanghai, Zalora, etc. |

Cashback Eligibility And Cap

You’ll need to spend at least S$500 every quarter before you qualify for the 1% cashback rate. This works out to about S$167 in spending each month, so it’s easy to hit.

Only transactions above S$5 are eligible for cashback and total cashback each quarter is capped at S$100. This means a total of S$400 cashback a year, which is not too bad considering it’s free money on top of your credit card cashback rates!

Of course, like most other cards, payments made to institutions such as schools, tax authorities, and insurance companies are not eligible for cashback. You can view the full list of ineligible merchants here.

Best Credit Cards to Pair Instarem Amaze With

| DBS Woman’s World Card | Citi Cashback+ | Citi Rewards Mastercard | SCB Unlimited Cashback Credit Card | |

|---|---|---|---|---|

| Income Requirements | S$80,000 and above | S$30,000 | S$30,000 | S$30,000 |

| Minimum Spending Required | None | None | None | None |

| Perks | 2-20 miles per S$5 spent on online purchases | 1.6% cashback | Up to 4 miles per S$1 spent online or with Grab/GoJek | 1.5% cashback |

| Miles/Points/ Cashback Cap | Bonus points only apply to first S$2,000 spending per calendar month | Unlimited | 10,000 points per statement month | Unlimited |

DBS Woman’s World Card

If you have an annual income of above S$80,000, this card gives you extra miles on top of the 1% cashback from Instarem.

There’s also an alternative to this card — the DBS Woman’s Card — that has lower income requirements (S$30,000 annually) but has half the benefits of the DBS Woman’s World Card.

With no minimum spending requirements, you stand to earn for every S$5 spent:

- 10X DBS Points (or 20 miles) on online purchases

- 3X DBS Points (or 6 miles) on overseas purchases

- 1X DBS Point (or 2 miles) on all other purchases

- Additional discounts at various merchants

But… there’s always a but for the good stuff!

The 10X DBS Points only apply to the first S$2,000 spent online each month.

Citi Cashback+

At 1.6%, the Citibank Cashback+ card currently reigns as the highest cashback credit card from Mastercard. No minimum spending is required to be eligible for cashback and there is no cashback cap.

What are some of the benefits you can obtain with this card?

- 1.6% cashback on daily spending

- Exclusive deals and discounts locally and in 95 other countries

Citi Rewards Mastercard

If you prefer earning miles or points instead, consider adding the Citi Rewards Credit Card too. With no minimum spending requirement, here’s what you get for every S$1 spent:

- 10X Rewards (4 Miles) on online and shopping purchases

- 10X Rewards on rides with Grab, Gojek, etc.

- 10X Rewards on online food delivery and groceries

- 1X Reward on all other retail spending

- Complimentary travel insurance when you charge your airfare to the card

- Exclusive deals and discounts locally and in 95 other countries

Note: You can only earn up to 10,000 points each month. If S$1 = 10 points, then your points are capped at the first S$1,000 you spend.

SCB Unlimited Credit Card

Similarly, the Standard Chartered Unlimited Cashback Credit Card has no minimum spending requirement. Here’s what it offers:

- 1.5% cashback on all spending with no cap on cashback

- Access to offers at over 3,000 outlets in Asia from dining to shopping, travel, and lifestyle benefits

Instarem vs Other Multi-Currency Linked Cards

Here’s how the Instarem Amaze card stacks up against similar offerings from multi-currency accounts:

| Instarem | Wise | Revolut | YouTrip | |

|---|---|---|---|---|

| FX Exchange Rates | Mid-market Rates | Mid-market Rates | Mid-market Rates | Mid-market rates |

| ATM Withdrawal | No | Yes | Yes | Yes |

| Able to store multiple currencies? | No | Yes | Yes | Yes |

| Able to remit money? | Yes | Yes | Yes | Only to other YouTrip users |

| Compatibility with Electronic Payment Platforms | Google Pay | Apple Pay, Google Pay | Apple Pay, Google Pay | N.A |

Feature-wise, Wise and Revolut stand out as you can withdraw and remit money in addition to maintaining a multi-currency wallet through Apple or Google Pay.

YouTrip allows you to store multiple currencies in one wallet and withdraw cash from ATMs, but you can’t remit money to bank accounts overseas. You’ll also have to keep the physical card with you because this card is not compatible with any e-wallet platforms.

Instarem only allows you to store one currency in your account. You can remit money and pay merchants, but you can’t withdraw cash from ATMs locally or overseas.

Overall, Instarem offers the best MCA-linked card for cashback.

But if you’re looking for discounts and deals, YouTrip is a better option.

Exchange Rate Comparisons

With so many other multi-currency linked cards in the market already, which card should you choose?

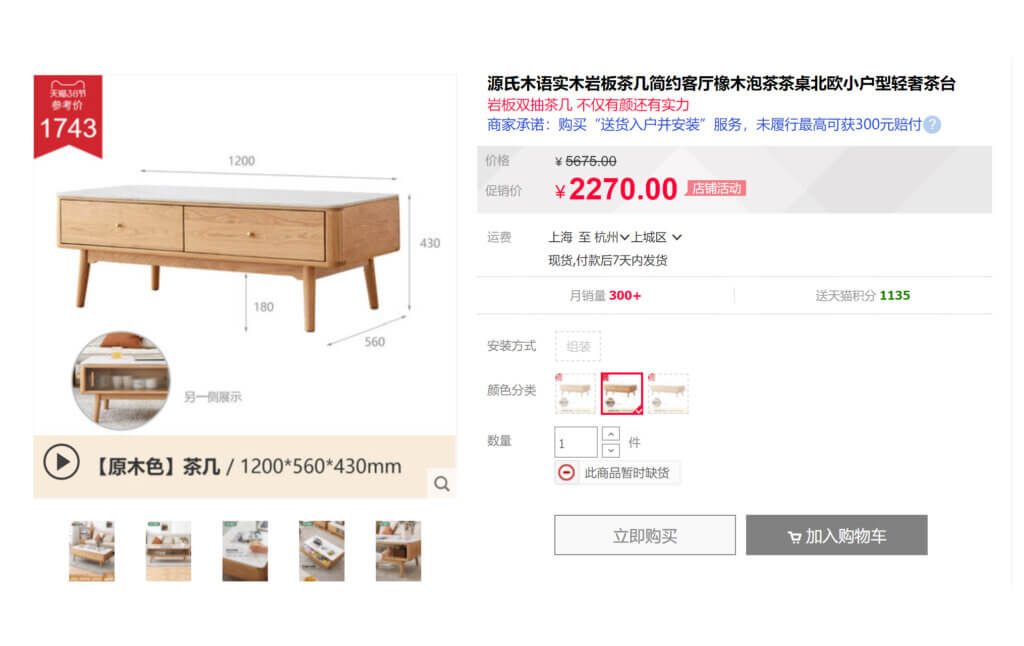

Let’s do a quick comparison. Imagine a scenario in which you’re looking to furnish your new home with items from Taobao. This coffee table is one of the pieces you have your eyes on:

Here’s how much the coffee table would cost when purchased via the various MCA-linked cards:

| Instarem | Wise | Revolut | YouTrip | DBS | |

|---|---|---|---|---|---|

| Issuer | Mastercard | Mastercard | Visa | Mastercard | Visa |

| Exchange Rate (SGD/CNY) | 1 SGD = 4.6225 CNY | 1 SGD = 4.6303 CNY | 1 SGD = 4.6288 CNY | 1 SGD = 4.6244 CNY | 1 SGD = 4.6126 CNY |

| Fees | None | None | 1% on weekends | None | 3.25% FX fees |

| Rewards | 1% cashback | None | 1% cashback at metal tier | None | None |

| Price on Checkout (SGD) | 491.08 | 490.25 | 490.41 | 490.87 | 492.13 |

| Price after Cashback (in SGD) | 486.17 | 490.25 | 485.51 (Metal tier), 490.41 otherwise | 490.87 | 492.13 |

The figures above are based on the costs of paying with a regular debit card. It does not take into consideration any of the credit card perks from your linked cards.

If you link any cashback cards such as the Citi Cashback+, then you could potentially earn 1.6% + 1% cashback.

Although this is only one comparison, it’s clear that the Instarem Amaze’s cashback offer is enticing — especially considering how hassle-free the card is.

Bottom Line

The Instarem Amaze card is a rare gem as it gives extra cashback benefits on top of your usual credit card perks. If you often transact in foreign currencies, definitely consider picking one up.

Since you can link 5 different Mastercards to the Amaze, it’s also a great way to declutter your wallet so you won’t have to bring so many cards out. It’s a fuss-free and easy-to-manage card with no fees or top-ups needed unlike a credit or prepaid card.