Editor’s Note: Updated on 3 Aug 2022 to reflect the revised interest rates from the DBS Multiplier.

Pros

- No minimum deposit

- High effective interest rate of 2.38% p.a.

- Access 14 currencies with no FX fees

- Easily earn bonus interest with daily transactions (credit salary, card spending, and bill payments)

Cons

- Lower-than-average base interest of 0.01%

- High card spending requirement of $2,000

- Bonus interest is heavily weighted toward insurance and investments

- Minimum salary credit of $3,000

Standard Chartered’s Bonus$aver Account can net you interest of up to 2.38% p.a. for your first S$80,000. That’s a relatively high interest rate in today’s environment. However, getting the full 2.38% will require a lot of effort on your end.

We’ll review the BonusSaver account and compare it with other options on the market to see just how good it is:

- How the Bonus$aver works

- How much interest can you really get?

- Bonus$aver vs other savings accounts

- Whom the Standard Chartered Bonus$aver is best for

Product Summary

| Base interest rate | 0.01% p.a. |

| Maximum interest | 2.38% p.a. |

| Minimum average daily balance | S$3,000 |

| Fall-below fees | S$5 |

| Minimum initial deposit | None |

| Credit card annual fee | S$214 (with 2-year fee waiver) |

| Debit card annual fee | S$20 |

| Cheque book charges | S$10 for each cheque book |

How the Standard Chartered Bonus$aver Works

The Bonus$aver account has five main pillars. Meeting the requirements for each will earn you bonus interest on the first S$80,000 in your account.

The sum of all five pillars will earn you an effective interest of up to 2.38% p.a. These pillars are applied independently, so you can still earn a bit of bonus interest even if you don’t meet the criteria for all of them.

Here’s the breakdown of the five pillars:

1. Card Spend (up to 0.40%)

The account comes with your choice of a credit or debit card, both of which have their own respective fees. Spending at least $500 gets you 0.20% p.a. bonus interest; over $2,000 earns you 0.40%.

While the rates are much better than the paltry 0.05% p.a. you get with a typical savings account, they’re still lower than what you can get with cashback-focused credit cards.

In addition, other savings accounts either have a lower minimum spending requirement or allow users to meet the minimums with transactions in other categories.

2. Salary Credit (0.1%)

You’ll need to credit a monthly take-home salary of at least $3,000 via GIRO to earn the bonus interest. This means that lower-salaried earners or those with irregular income will not benefit much from this account.

In contrast, options like the UOB One Account allow you to earn bonus interest with a lower salary. The UOB One, in particular, also allows you to substitute salary credit with paying 3 bills by GIRO every month.

3. Invest (0.9%)

This is where the Bonus$aver gets tedious, in our opinion. The investment category is one of the two most heavily weighted for the bonus interest, and with restrictive requirements: you must invest a minimum of S$30,000, and only in a StanChart Unit Trust.

That said, if you happen to be looking for new investments, the Bonus$aver is one way to take advantage of that.

4. Insure (0.9%)

This is the other heavily-weighted category. You must purchase an eligible insurance policy with a minimal annual premium of S$12,000 to earn 0.90% p.a. bonus interest for 12 months. Standard Chartered offers a regular premium life insurance policy underwritten by Prudential.

For some context, the AXA Life Treasure plan costs about $4,000 per year for coverage of $430,000.

5. Bill Payment (0.07%)

You’ll need to make three eligible bill payments of at least $50 each (in a calendar month) via GIRO to earn a 0.07% p.a. bonus interest.

How Much Interest Can You Really Get?

Realistically, you may not spend $2,000 on the card each month just to qualify for the extra 0.40% in interest. We also don’t recommend putting tens of thousands into investments or insurance plans just for that bonus 1.8%.

Here’s what you’d get in interest without buying insurance or investments:

| Card Spend of Less than $500 + Salary + Bill Payments | 0.18% p.a. |

| Card Spend of $500 to $1,999 + Salary + Bill Payments | 0.38% p.a. |

| Card Spend of More than $2000 + Salary + Bill Payments | 0.58% p.a. |

We’ll compare this rate with offerings from other banks next.

Bonus$aver Account vs. Other Savings Accounts

The Standard Chartered Bonus$aver Account’s 2.38% may be decent, but it’s not the only option out there offering that rate. Let’s see how it stacks up with other high-interest savings accounts:

| Interest Rate | Fees | |

|---|---|---|

| Standard Chartered’s Bonus$aver Account | Base interest rate: 0.01% Effective Interest Rate: Up to 2.38% p.a. on the first $80,000 | Initial deposit: $0 Min balance: $3,000 Fall-below fee: $5 |

| DBS Multiplier | Base interest rate: 0.05% Effective Interest Rate: Up to 3% p.a. on the first S$100,000 | Initial deposit: $0 Min balance: $3,000 Fall-below fee: $5 |

| OCBC 360 | Base interest rate: 0.05% Effective Interest Rate: Up to 2.38% p.a. on the first $75,000 | Initial deposit: $1,000 Min balance: $3,000 Fall-below fee: $2 |

| UOB One Account | Base interest rate: 0.05% Effective Interest Rate: Up to 1% p.a. on the first $75,000 | Initial deposit: $0 Min balance: $1,000 Fall-below fee: $5 |

DBS Multiplier Account

The DBS Multiplier Account is a popular choice known for its high interest rate. You can earn up to 2.5% on the first S$50,000 and up to 3.5% on the next S$50,000 of your bank balance, making the effective interest rate 3% per year.

Compared to the Bonus$aver, the DBS Multiplier Account is more flexible. You’ll earn your bonus interest as long as you hit the requisite amount in eligible transactions, but it’s up to you how you want to split those up among the categories.

It doesn’t have a minimum salary or insurance requirement, for example. Home loans are also an eligible category here, which could easily be a few thousand in eligible transactions.

The DBS Multiplier also works well as a joint account, which means couples could combine their eligible transactions to reach the maximum effective interest rate.

Read also: 5 Best Joint Savings Accounts for Singapore (2022)

Even if you were only to credit your salary, spend on a linked card with decent perks, and take out a home loan, you’d probably still earn a minimum of 1.30% p.a. on the first S$50,000 in your bank balance. Overall, we’d say the DBS Multiplier’s requirements for bonus interest are easier to achieve than the Bonus$aver’s.

OCBC 360 Account

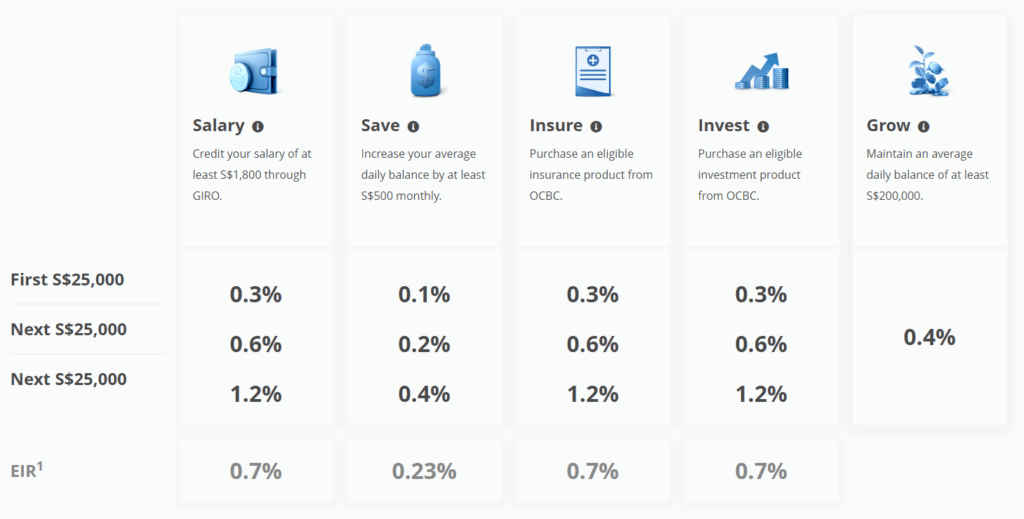

Like the Bonus$aver, the OCBC 360 Account is divided into independent bonus-interest pillars: Salary, Save, Insure, and Invest. Engaging in all four pillars can earn you an effective interest rate of up to 2.38% p.a. on the first S$75,000 in your bank balance.

The OCBC 360 Account only requires a salary credit of S$1,800 monthly to get you between 0.3% to 1.2% in bonus interest. And unlike the Bonus$aver, the Insure and Invest categories here are weighted the same as the salary crediting requirement – with lower minimum premiums and investment amounts to qualify for the bonus interest.

But even if all you do is credit your salary and save, you’ll still earn an effective interest rate of up to 0.98% annually on a bank balance of $75,000. That’s still higher than the Bonus$aver’s 0.58%.

UOB One Account

Of the choices here, the UOB One Account has the lowest effective interest rate (1%) for a S$75,000 bank balance – but it’s also the lowest-maintenance account. To get the bonus interest, all you have to do is spend S$500 on an eligible UOB card and either credit your salary or make 3 GIRO transactions per month:

This makes the UOB One a great option for those starting out in their adulting journeys. If you don’t see investments, home loans, or life insurance premiums in your immediate future, this could be a way to earn interest while you grow your savings.

Whom the Standard Chartered Bonus$aver is Best For

In summary, 2.38% interest annually sounds pretty appealing, but you’ll have to jump through a lot of hoops to get there. For this reason, we’d say this account is best for moderately high earners and spenders who happen to have idle cash they’d like to put into insurance and investments.

If you’re not intending to insure or invest through Standard Chartered, however, you’re better off with alternative high-interest savings accounts like the DBS Multiplier or UOB One.